Turn Chat into Knowledge

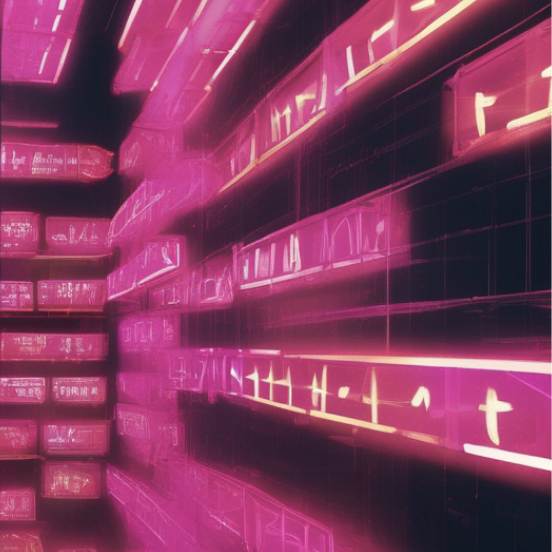

Infinitely-threaded chat for organizing conversations and research

Chat to Capture & Curate Knowledge

Treechat is a real-time, threaded chat app that lets you branch a new thread from any message.

Use branch threads to write replies, elaborate with examples, or annotate with research, then branch them again.

As you write, a hierarchical structure called a thread-tree emerges to organize the insights, tasks, and decisions your conversations generate.

Upvote the best messages to make it easy to recall the best threads and the thread-tree contexts which inspired them.

Flat chat destroys conversation context by forcing you to post messages from unrelated conversations into a single channel, mixing relevant and irrelevant messages together.

Escape Flat Chat

Unlike Treechat, flat chat cannot re-assemble conversations from the mix of messages flowing through a channel. This makes it impossible to re-construct a conversation from search results, dumbing down flat chat into a purely synchronous communication tool.

Treechat posts messages inside a super-lightweight, infinitely-branching thread-tree structure that transforms ephemeral chat messages into knowledge assets, by letting you return to them, so you can reference, share, and improve them.

Treechat makes it easy to find threads again, so "chat" becomes useful for async communication, knowledge and project management without switching apps.

Sync + Async

Being able to start focused threads and easily recall them makes it possible to respond to messages on your own time without worrying about relevant messages scrolling above the fold, forced off the screen by a flood of irrelevant ones.

When all users are present at the same time, Treechat excels by organically branching to capture the multiple directions conversations inevitably take with users describing the experience as "high bandwidth conversation".

Multiplayer Knowledge

Use thread trees to mimic outlines, or file systems, or quote one thread into another to create knowledge graphs with backlinks. Start private threads to brainstorm and compose then @mention your friends to invite them to collaborate.

Create custom streams with exclusive membership and tag threads with [[memes]] to organize your content by the topics you care about. As your knowledge base grows, use upvotes to prioritize the best threads for a particular [[meme]] or in search results.

Task Management

Treechat threads are just lists. You can use them to post chat messages, but you can also make lists of projects and tasks, mention team mates in a branch thread to assign, and upvote to prioritize.

When an item is done archive to hide it from view. When you need to find it again, just search for it. The thread tree structure will record a history of your work and the conversations which inspired it.

AI Agents as First Class Citizens

Invite a GPT4 powered AI agent to chat in any thread to answer questions, generate ideas, or just chat. Treechat agents understand the thread-tree structure so you can take the conversation in any direction you want just as you might with a human.

Treechat provides agents who will do internet research, and generate images. The images on this page were generated by Treechat in conversation with an agent with access the Stable Diffusion XL image model.

Treechat makes chat the source of truth for your organization or community.

A Space for Community Knowledge

Spaces are siloed instances of the Treechat app you can administer to capture and curate the insights posessed by your community or team.

Unlike typical chat tools, as you use Treechat you collaboratively grow a knowledge asset valuable both to past and future members and potentially an external audience.

The marriage of chat and reddit like upvotes allow your organization's best ideas to rise to the top, coordinating your attention and efforts.